The Prices of the Wheelchairs, Accessories, Options and Accessories are all shown with VAT included - However you can if applicable Opt to Pay for your items with the VAT at Zero ( Exempted)

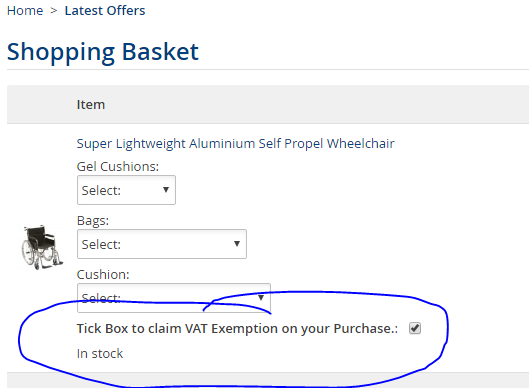

Just Tick the Box on the Shopping Basket Page and your Price will change to the Exempt Pricing

Example Below

If you have a long-term illness or are disabled, you don't have to pay VAT on certain goods and services that you buy in the UK. In general the equipment covered by this scheme are things that are of practical help to you because of your illness or disability.

If you are in any doubt as to whether you are eligible to receive goods or services zero-rated for VAT you should consult Notice 701/7 VAT reliefs for disabled people or the HMRC National Advice Service on 0845 010 9000.

What counts as a long-term illness or disabled? For VAT purposes, you have a long-term illness or are disabled if you meet any of the following conditions:

you have a physical or mental impairment which has a long-term and substantial adverse effect upon your ability to carry out everyday activities

you have a condition that the medical profession treats as a chronic sickness, such as diabetes

you are terminally ill.

So if you don't qualify if you are elderly but otherwise able-bodied, or if you're only temporarily disabled or incapacitated.You don't have to physically buy the goods in person. If your parent, guardian, wife or husband buys the goods and services for you, then you will not be charged VAT.

What counts as personal or domestic use? Personal or domestic use means that the goods or services are supplied for your own private use, rather than for business purposes. If you are purchasing for a business please call us and we will assist you in placing your order.